Is GOLD, like Ferdinand, just a different kind of bull?

“Ferdinand entered the ring and stood in the center. Many were expecting him to start charging around. There weren’t any flowers in the ring and Ferdinand just sat there quietly. The performers in the ring were all so disappointed and sad. They took Ferdinand home. Now, he could continue to smell the flowers and be happy.”

The story of Ferdinand, the peaceful, flower-loving bull has long been a favorite. Though Ferdinand is as big and strong as the other bulls, he’s not into violence or putting on a show. He is into sitting quietly under a tree, smelling the flowers. While the other bulls charge about and compete for their chance to be in the bull fighting ring, Ferdinand is not interested.

However, when he is provoked by a bee he can snort and puff and paw at the ground and be as fierce as any of the other bulls, attracting the attention and admiration of the townspeople, but once he doesn’t perform as the other bulls do, they lose interest and mock him - and let him go back to being a bull, smelling the flowers under his favorite tree.

Is gold like this? In many ways, yes!

A portfolio position in investment grade GOLD is slow and steady, quietly preserving its owner’s purchasing power for years to come. No fuss, no drama, just stalwart and steady – yet very very powerful through the years.

But it CAN BE provoked into action!

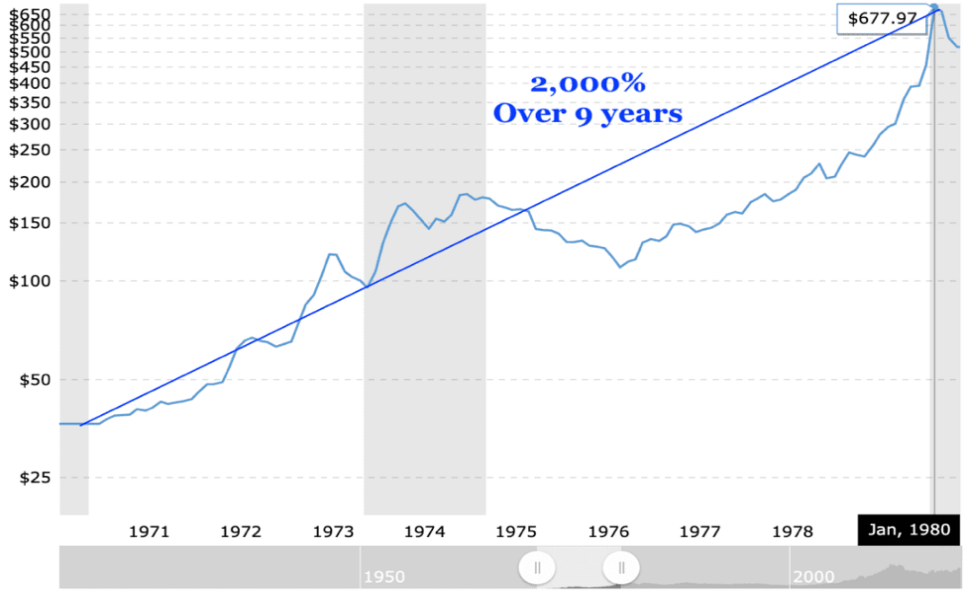

Like Ferdinand sitting on the bee, let’s look at what GOLD has done in the past when it felt the sting of economic turbulence! In the great bull run of gold from 1971-1980 gold bellowed and bucked from $35 an ounce to an astounding $678 for a 2000% gain!

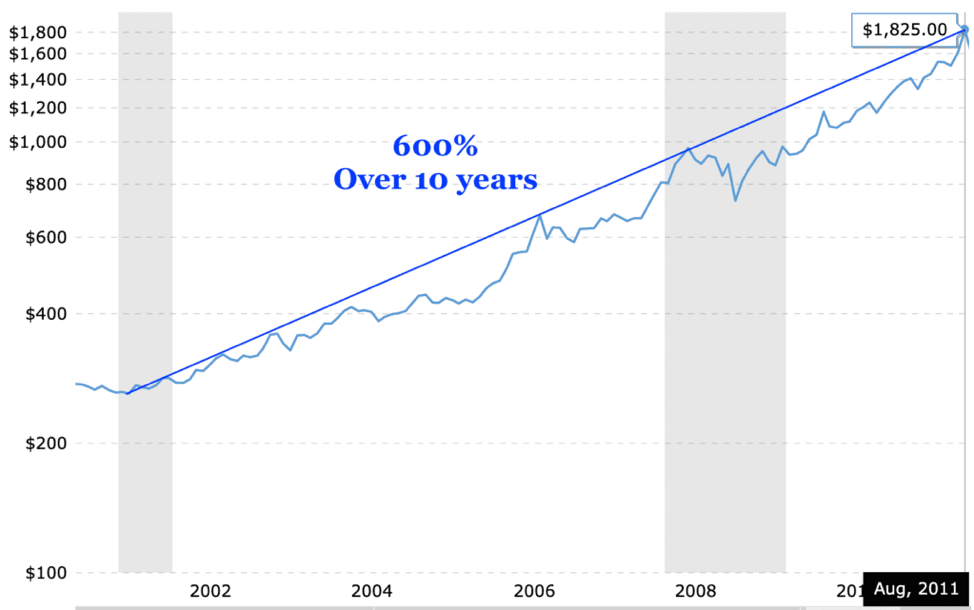

In another major bull run from 2001 to 2011, gold screamed from $250 to a high of $1825 an ounce! That is 600% over 10 years!

In another major bull run from 2001 to 2011, gold screamed from $250 to a high of $1825 an ounce! That is 600% over 10 years!

Quite a bee in the bonnet!

Quite a bee in the bonnet!

What if we are at the start of another major run-up similar to these two events?

Gold is certainly being provoked again with the same stings as before – crazy amounts of debt and debasement of the currency, political and economic uncertainty, the Fed getting into (not) QE (again) and expanding its balance sheet, trade wars with China and an accelerating de-dollarization around the world. Many economic indicators are sounding the alarm bells and Streetwise Reports is wondering if we are in the middle of the next leg up – and what it might look like if it mimicked the other two.

If it’s a 70’s-like run-up, we could be headed to $22,500 by 2025. If its more like the 2000’s, we would be at $8,000 by then.

A different kind of bull, a different kind of bull market

Gold and Ferdinand have one thing in common for sure: They are misunderstood by the average person. Once Ferdinand had the spotlight but didn’t roar and stomp and charge about, people got disappointed in him and dismissed him. But the joke is on them – he got to live out his days in peace under his tree.

He survived!

How many raging bulls were ruthlessly slaughtered to cheers and applause when they performed as the crowd wanted and expected?

It is the same when investors scoff at gold when it doesn’t perform like a stock or pay dividends and strut about. They don’t understand that gold is a different kind of animal.

Gold is for the patient investor who can allow it to sit quietly and smell the flowers, so to speak. Gold is for the long term, but make no mistake. Just like Ferdinand was an enormous and strong bull, gold is truly an investment powerhouse.

When other investment vehicles might catch the attention of the crowd, blow up and fizzle out, gold and precious metals will still be there for you, surviving and thriving long into an uncertain future. The holidays are a perfect time to add some bull market to your portfolio. Call us today!