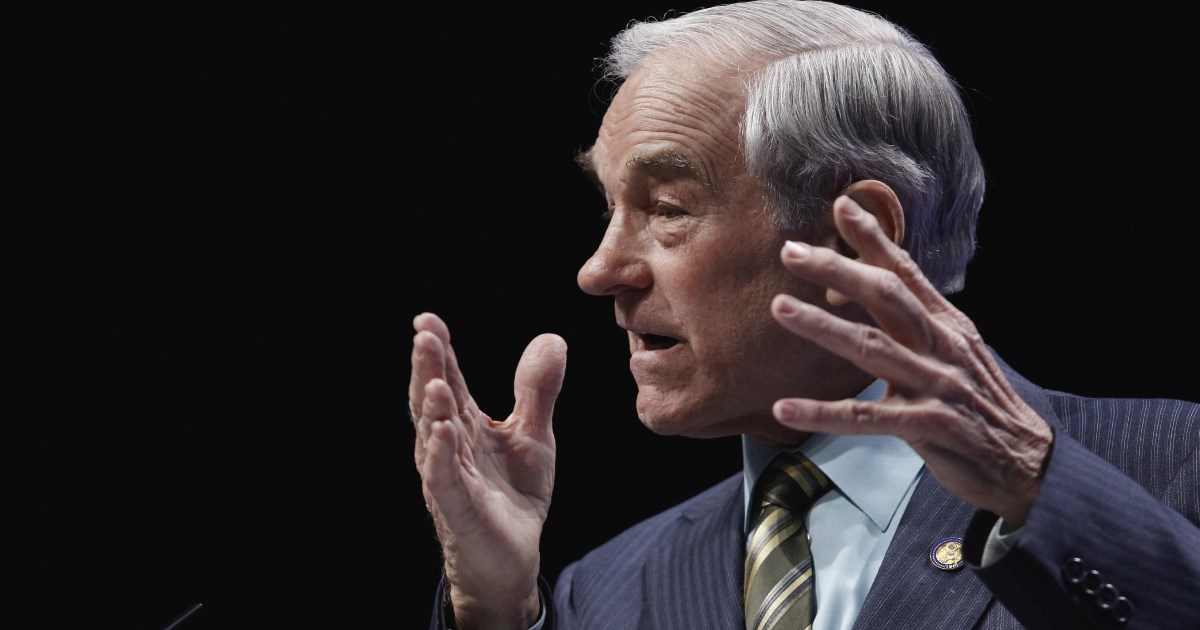

Ron Paul on Geopolitical Forces Undermining the Dollar

Many of the United States’ key allies’ participation in the newly formed Asian Infrastructure Investment Bank (AIIB), struck Larry Summers as a demotion of the United States on the world economic stage. Ron Paul, as usual, has a different take on this potential new “competitor” to the IMF.

In a recent report, Ron Paul pointed out the incredibly bad “investment” the IMF just made in Ukraine:

“A responsible financial institution would not extend a new loan of between 17 and 40 billion dollars to a borrower already struggling to pay back an existing multi-billion dollar loan. Yet that is just what the International Monetary Fund (IMF) did last month when it extended a new loan to the government of Ukraine. This new loan may not make much economic sense, but propping up the existing Ukrainian government serves the foreign policy agenda of the US government.”

Incredibly poor business choices are being indirectly saddled on the American taxpayer. However, according to Ron Paul, the IMF is not so much a multinational investment bank, but a financial arm of US foreign policy:

“The IMF also has a history of using the funds provided to it by the American taxpayer to prop up dictatorial regimes and support unsound economic policies.

“Some may claim the IMF does promote free markets by requiring that countries receiving IMF loans implement some positive economic reforms, such as reducing government spending. However, other conditions imposed by the IMF, such as that the country receiving the loan deflate its currency and implement an industrial policy promoting exports, do not seem designed to promote a true free market, much less improve the people’s living standards by giving them greater economic opportunities.”

Perhaps the most alarming revelation is evidence of probable behind the scenes manipulation of global currency exchange markets by a mysterious buyer in Belgium.

“Over the past several years, a mysterious buyer, identified only as “Belgium,” so named because the buyer acts through a Belgian-domiciled account, has become the third-largest holder of Treasury securities. Belgium's large purchases always occur at opportune times for the US government, such as when a foreign country sells a large amount of Treasuries. “Belgium” also made large purchases in the months just after the Fed launched the quantitative easing program. While there is no evidence this buyer is working directly with the US government, the timing of these purchases does raise suspicions.

“It is not out of the realm of possibility that the Federal Reserve is involved in these purchases. The limited audit of the Federal Reserve’s actions during the financial crisis that was authorized by the Dodd-Frank Act revealed that the Fed actively intervenes in global markets.”

One thing is apparent. The US has been overplaying its economic hand for quite some time and it is all coming to an end. The formation of the AIIB is just the latest evidence of this. These geopolitical forces are at work propping up a currency that has impossible fundamentals, and yet we depend on it for day to day functioning as well as long term planning.

The dollar is our very economic life blood. Yet, because of the IMF, the Federal Reserve, and other powerful entities, the dollar has become a fiat house of cards just waiting to collapse. How much longer can it teeter on the brink? What will be the catalyst that brings it all down?

Ron Paul was asked just that recently on CNBC’s Futures Now.

“Most of the time these things are unforeseen. Most of the time there is a psychological element and a panic. If you have unsoundness and there’s no foundation and its just held together by confidence, what happens if the confidence is gone? Something might happen in Greece. Who knows what could happen there, and it may have ripples.

“Did anybody warn us about 2007, 2008 and Lehman Brothers? Nobody warned us about that. The malinvestment was there. It’s all out there and its very very fragile. To be confident and not sweat it is [to be] in denial. There’s a system that is very fragile. Exactly how it transpires, hard to say, but there is going to be some international economic or geopolitical event…”

In other words, the exact event and timing that precipitates the crash cannot be predicted. All we can do is examine the fundamentals and economic conditions that are lining up and notice that a correction, a very deep one, is long overdue and prepare the best we can.

Congressman Paul is, of course, a big believer in gold in the event of crashes and corrections.

The dollar will continue to be debased. The dollars in YOUR pocket will continue to lose value. Gold is the safe haven in the currency storm. Call us today to exchange some soon-to-be worthless Federal Reserve notes for rock solid gold today.