Investment Performance

Premium Track Record of Performance

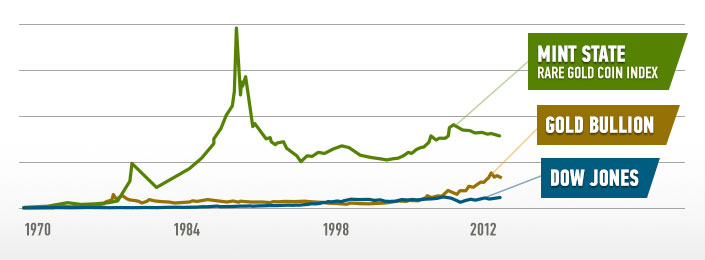

According to the CU 3000 Index, the standard of premium coin performance, a $1,000 investment in a “basket” of generic gold coins purchased in 1970 was recently worth $39,500.

Meanwhile, a $1,000 coin portfolio of mint state gold coins grew over that same time to over $105,995.99. Compare that to the Dow, where $1,000 invested in 1970 is worth $18,300.

Over the fifteen recessions the U.S. as experienced since 1919, premium rare coins have performed particularly well. During the period from 1981 to 1989, for example, a time most notable for the ending of a recession and the nightmarish stock crash of 1987, the CU 3000 Rare Coin index shot up an astounding 660 percent.

This trend is important to keep in mind since bear markets in most investments tend to last between 30 to 50 percent as long as the bull market it follows.

Comfort During a Recession

This bull/bear relationship is evident throughout our economic history. For example, the bear market following the Great Crash of 1929 lasted half as long as the bull market, ending in late 1932, a full three years later yet it still took 25 years before those unfortunate investors would break even. Likewise, the 1973-74 bear market in stocks lasted just two years, but most of the investors who suffered through it would not see the break even point for another 12 years.

Diversification into precious metals can help offset the negative effects an uncertain economy can have on paper investments.

Check out our Premium Coin Analyzer today!

The statements made on this Website are opinions only. Past results are no guarantee of future performance or returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same depending on a variety of factors. Lear Capital, LLC cannot guarantee, and makes no representation, that any metals purchased will appreciate at all or appreciate sufficiently to make customers a profit. Lear is a retail seller of precious metals and its buyback (or bid) prices are lower than its sell (or ask) prices. Metals must appreciate enough to account for this difference in order for customer to make a profit when liquidating the metals. Lear does not provide financial advice or retirement planning services. The decision to purchase or sell precious metals, and which precious metals to purchase or sell, are the customer’s decision alone, and purchases and sales should be made subject to the customer’s own research, prudence and judgment.