2

“Whoever wishes to foresee the future must consult the past; for human events ever

resemble those of preceding times.”

– Machiavelli

LOW RATES AND

RISING METALS –

A 1965 REDUX

Back in 1965 Lyndon B.

Johnson was President

and ushered in his vision

of “A Great Society” for

the American People. The

average home price was

under $14,000. Gas was 31

cents per gallon, and a new

car was only about $2650.

1965 was the perfect time to

invest in oil, silver, gold and

other commodities that were

poised to skyrocket due to

extremely low interest rates!

As the nation watched My Fair Lady and crooned about

“The Eve of Destruction,” precious metals began a boom

that stretched 15 years before peaking in 1980. In fact,

gold rose from a low of $35 to over $850 an ounce giving

investors a whopping 2,400% profit. Silver was also up over

1,500 % during the same precious metals boom period.

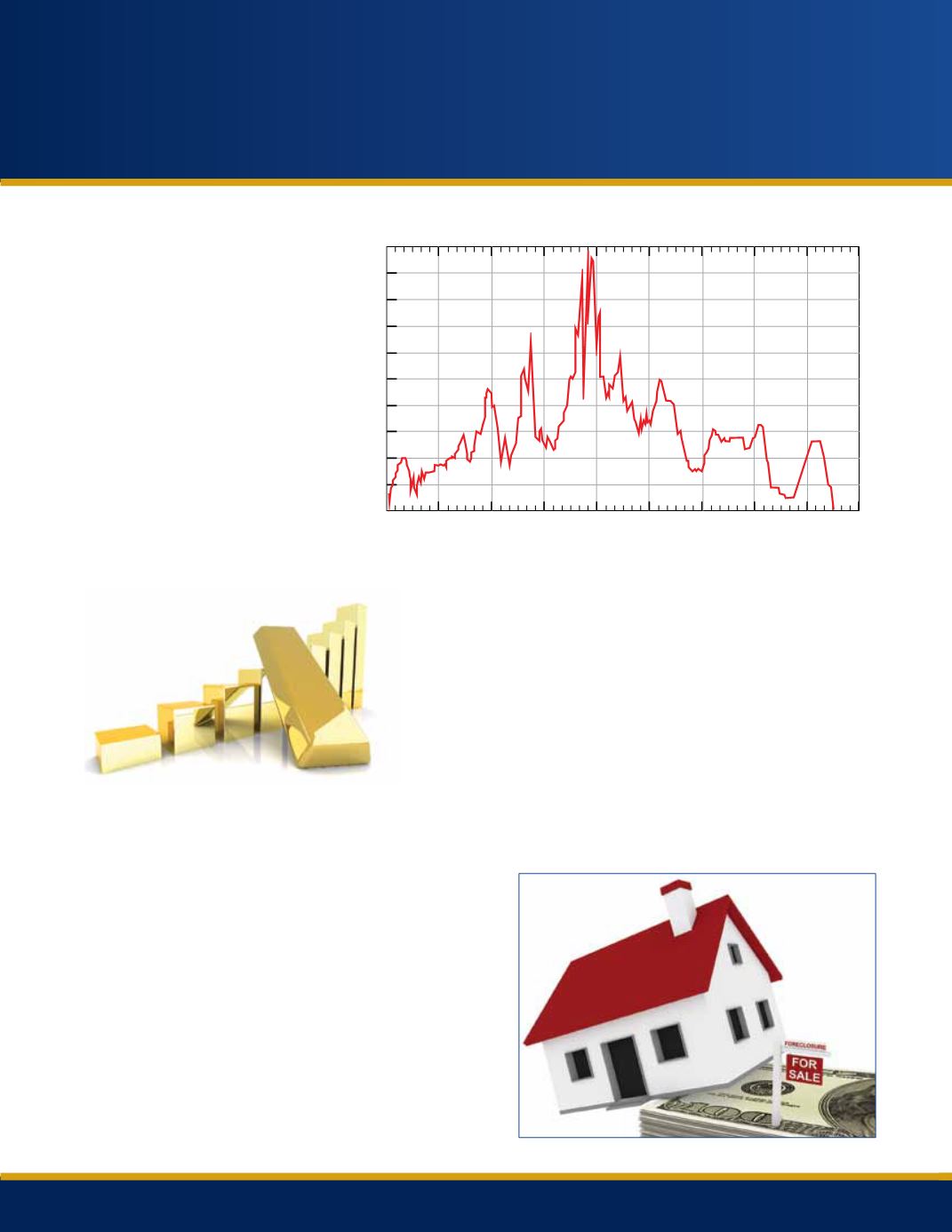

HIGH RATES AND REAL ESTATE – 1980 REVISTED

1980 saw the advent of the Middle East hostage crisis,

record-breaking gold prices, and soaring double digit

inflation. But, from 1965 to 1982 stocks rose just one-point

from a DJIA of 856 to 857. That’s a mere one percentage

“gain” or just .001% over seventeen, long years.

In that same year America boycotted the Olympic

Games, Mt. St. Helens erupted in Washington State,

and the Challenger Space Shuttle tragically exploded

off the coast of central Florida.All the while interest

rates steadily rose from 1.75% in 1965 to a peak of 15%

in 1980, crushing real estate lending. In November,

America welcomed the Reagan Revolution as Ronald

Reagan defeated President Jimmy Carter in the 1980

Presidential Election.

1965 1970

1958

1976 1982 1988 1994 2000 2006 2012

Date

Historical Interest Rates

Percent

20

18

16

14

12

10

8

6

4

2

0