1

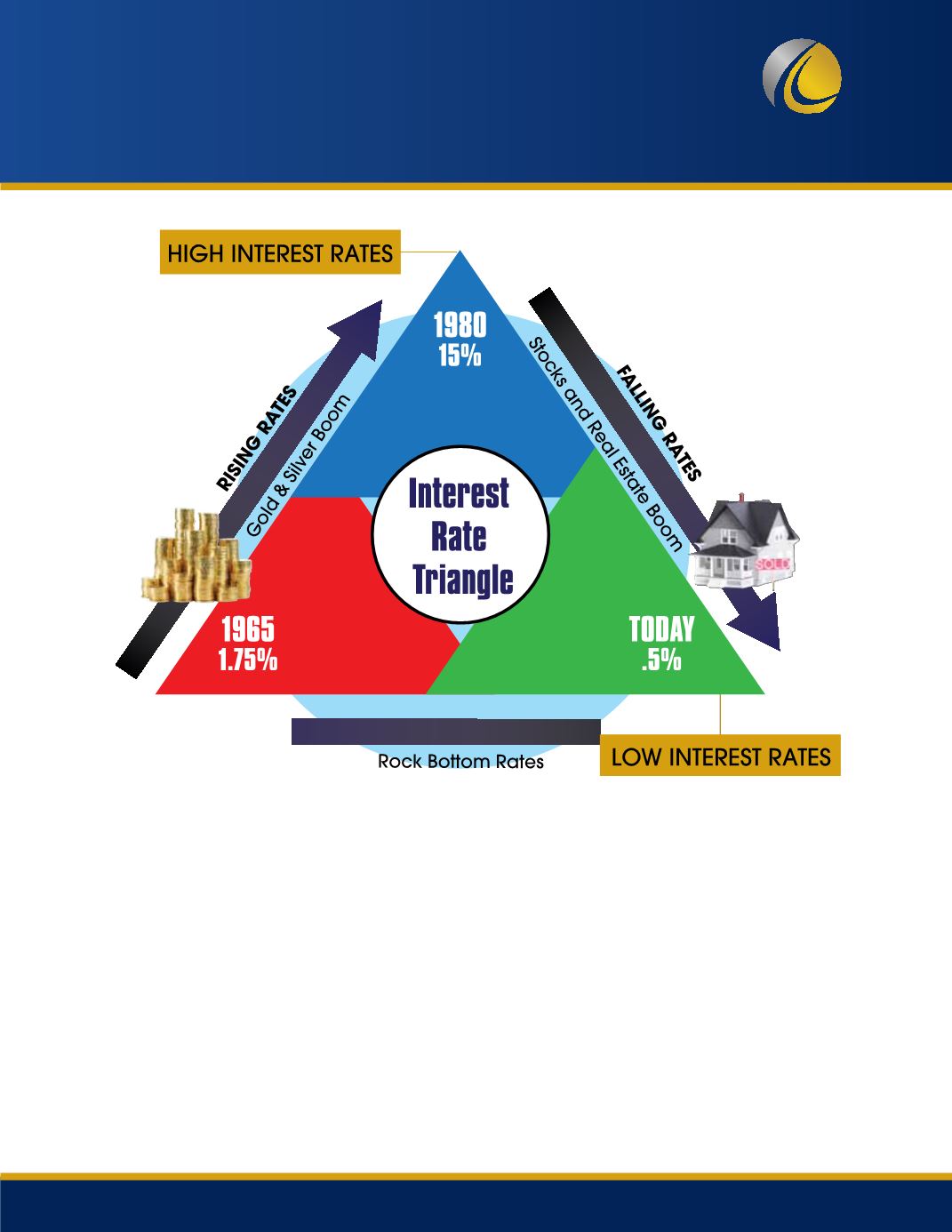

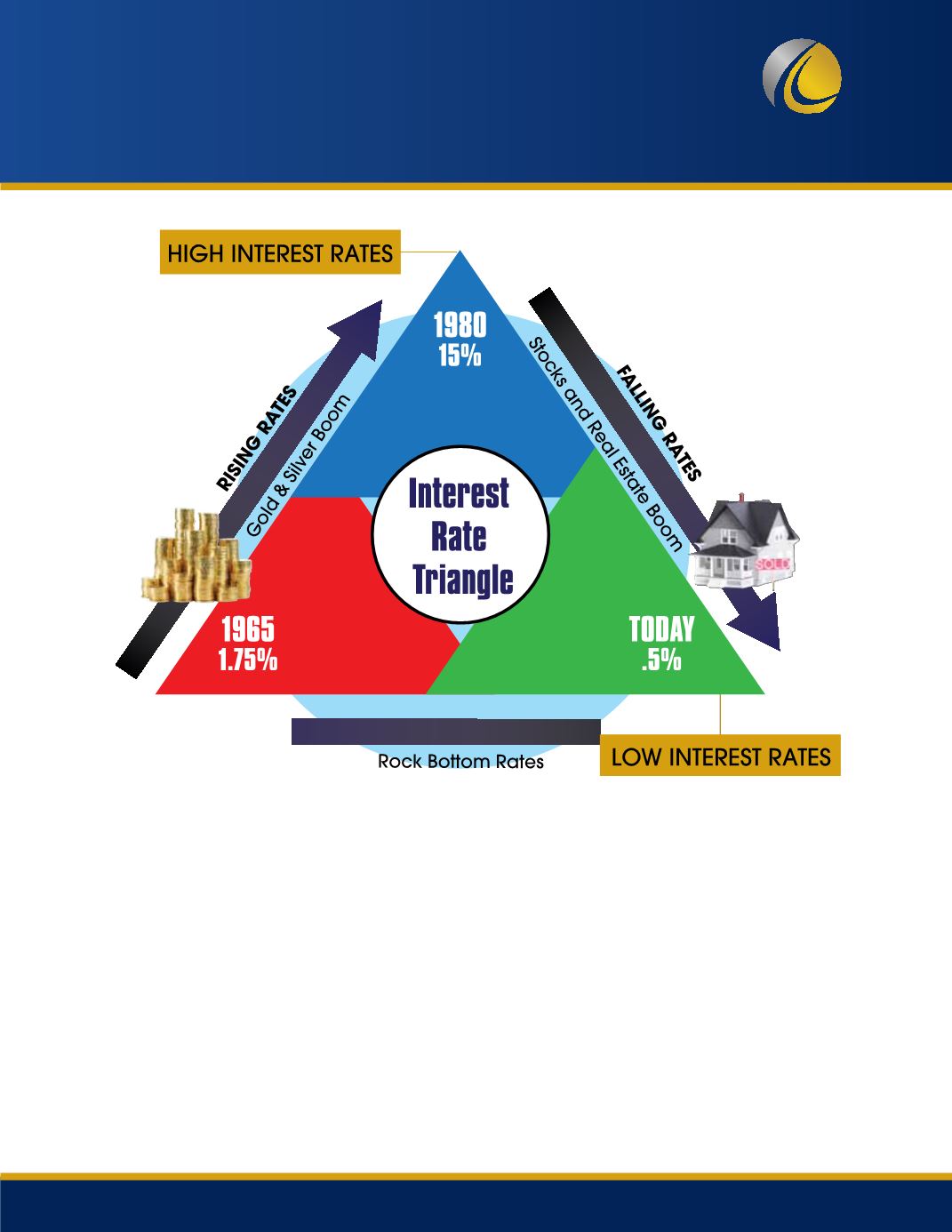

The Interest Rate Triangle

Re-Starting the 1965 Gold Bull Market

The Interest Rate Triangle is both a tool and a strategy that is used by some of the most successful

investors in the world to make investment selections within the reliable context of history. It offers a

powerful glimpse into financial trends and provides a quick, practical guide for making well-timed

investments.

In order to benefit from its lessons, you’ll need to consider two simple but important questions:

Are

interest rates HIGH and coming DOWN? Or are interest rates LOW and most likely to RISE?

The

answers to these questions and your resulting actions will directly impact your investment choices as well

as your prospects of financial success.

THE LESSONS OF 1965

In the past 45 years interest rates have risen from 1.75% in 1965 (see the interest rate triangle above) to a

peak of 15% in 1980, and then dropped to .5% today. This is not a unique cycle in the annals of financial

history. In fact, it’s a cycle that repeats itself. On the IRT above, locate where interest rates currently

stand. Now look back at 1965.What investment sector appears poised for another upward surge?

Understanding the golden lessons of 1965 can be the difference between substantial profits, losses and

potential windfalls.

LEAR

CAPITAL

The Precious Metal Leaders